How to Apply for PAN Card if lost, If your PAN card is lost, we will talk about it further. Now let us know why PAN card is important. Although PAN card is used for many purposes, some important reasons are given below. How is PAN card important for us and what are its uses?

Content Outline :

- Introduction

- Immediate Steps to Take

- Methods to Apply for a Duplicate PAN Card

Online Method

Offline Method - Apply duplicate PAN Card if you don’t have PAN Card Number

- Required Documents

- Fees and Charges

- Tracking the Application

Tax Identification: It helps the Income Tax Department track financial transactions and stop tax evasion by acting as a unique identifier for people and companies.

Financial Transactions: It is necessary for a number of financial transactions, including opening a bank account, purchasing or disposing of real estate, and making stock investments.

Proof of Identity: Throughout the nation, it serves as a legitimate proof of identity.

Loan Applications: When processing loan applications, banks and other financial organizations frequently need a PAN card.

Income Tax Returns: PAN cards are required for the filing of income tax returns, which are required for both people and entities having taxable income.

Common scenarios leading to the loss of a PAN card.

- Theft: PAN cards might be lost if wallets or handbags containing these are taken.

- Accidental Damage: PAN cards may sustain damage from fire, water, or other accidental events, making them useless.

- Loss During Transit: You went somewhere carrying your PAN card and lost it while travelling.

Reporting the Loss of a PAN Card

- Make a Police Report:

- File a lost report or a First Information Report (FIR) at the closest police station. Although optional, taking this step is advised, particularly if you suspect misuse.

- Notify the Department of Income Taxation:

- Notify the Income Tax Department of your PAN card loss. You can visit the closest Income Tax office or complete this online via their official website.

- Examine for Abuse:

- Make sure that your missing PAN card isn’t being misused by keeping a close eye on your credit reports and financial transactions. Any questionable activities should be reported right away.

Methods to Apply for a Duplicate PAN Card | How to Apply for PAN Card if lost

A. Online Method | How to Apply for PAN Card if lost

- Step 1: Visit the TIN-NSDL or UTIITSL website.

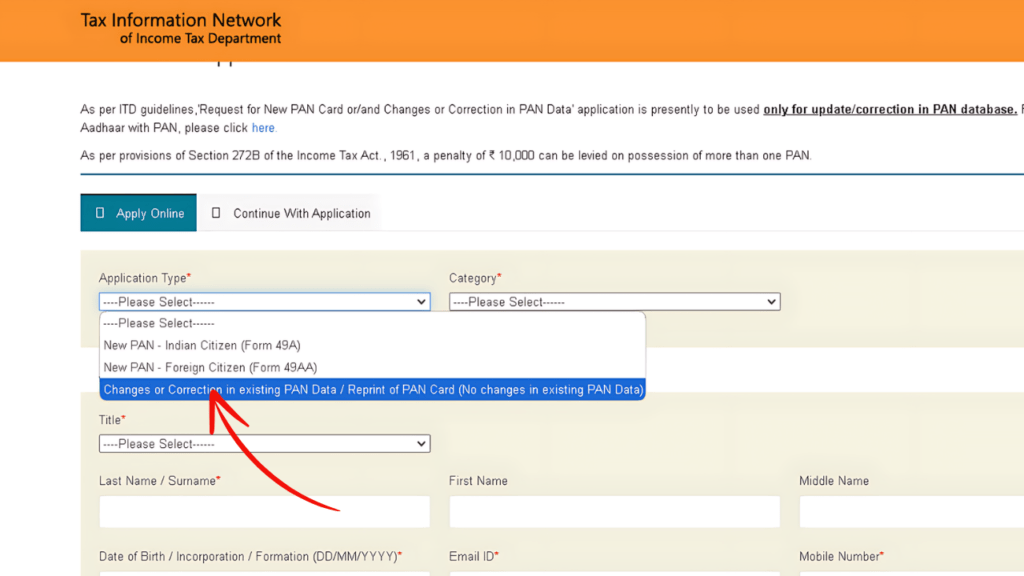

- Step 2: Select the option for “Reprint of PAN card” or “Changes or correction in existing PAN data”.

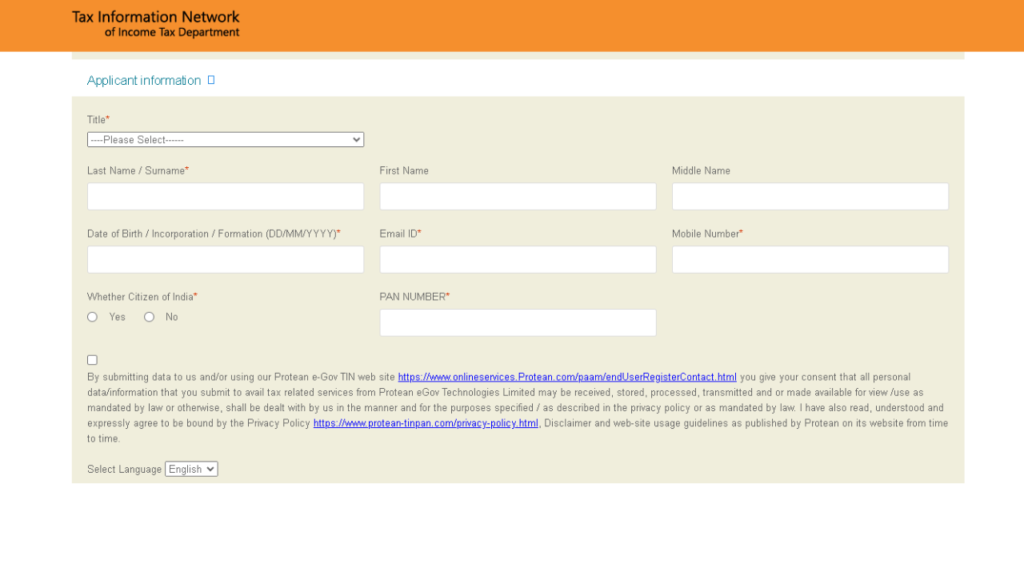

- Step 3: Fill in the required details.

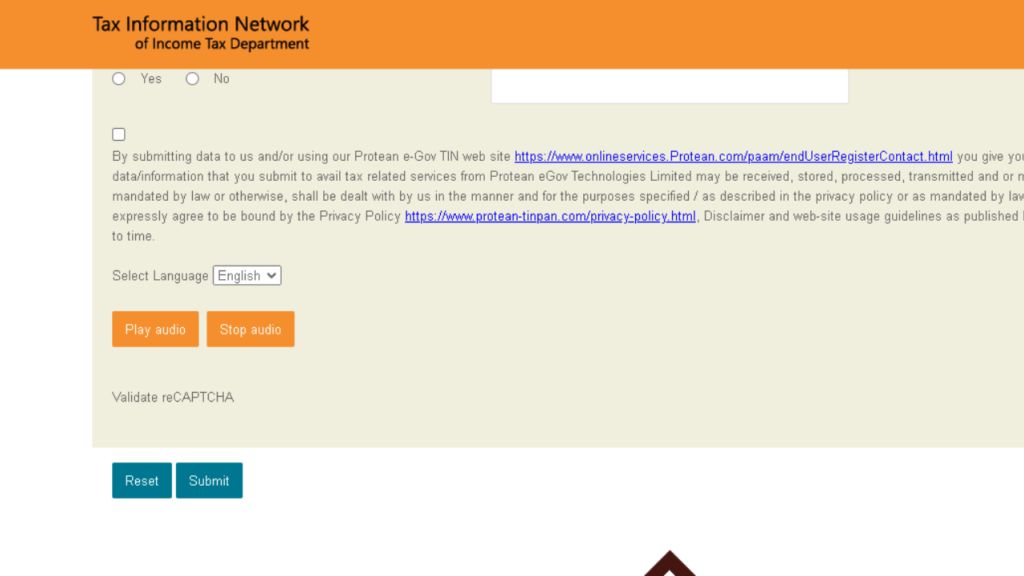

- Step 4: Submit the application and note the acknowledgment number or reference Number

- Step 5: Upload the necessary documents (if required).

- Step 6: Make the payment online.

- Step 7: Receive the duplicate PAN card by post.

B. Offline Method | How to Apply for PAN Card if lost

- Step 1: Obtain the PAN card application form (Form 49A).

- Step 2: Fill in the form with the required details.

- Step 3: Attach the necessary documents.

- Step 4: Submit the form to the nearest PAN card centre.

- Step 5: Pay the application fee.

- Step 6: Receive the duplicate PAN card by post.

C. Apply duplicate PAN Card if you don’t have PAN Card Number

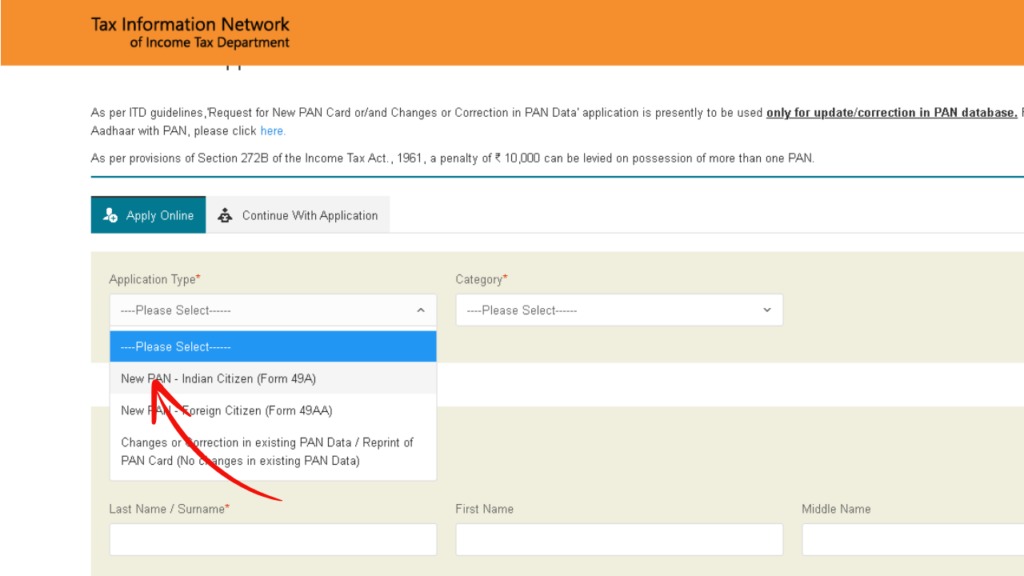

- Step 1: Visit the TIN-NSDL or UTIITSL website.

- Step 2: Select the option for “New PAN – Indian Citizen(Form 49A)”.

- Step 3: Fill in the required details.

- Step 4: Submit the application and note the acknowledgment number or reference Number

- Step 5: Upload the necessary documents (if required).

- Step 6: Make the payment online.

- Step 7: Receive the duplicate PAN card by post.

- Step 8: Call the NSDL Customer Care and ask them t know your PAN Card Number they’ll ask for your acknowledgement number then they’ll you, your pan card number.

Required Documents | How to Apply for PAN Card if lost:

- Proof of identity. (Aadhar Card)

- Proof of address. (Aadhar Card)

- Proof of date of birth. (Aadhar Card)

- Copy of the FIR (if applicable)(Aadhar Card).

Fees and Charges | How to Apply for PAN Card if lost

Online Application:

Within India:

- Physical PAN Card: ₹101 (inclusive of taxes) if submitted online through paperless modes (e-KYC & e-Sign / e-Sign scanned based / DSC scanned based)

- e-PAN Card: ₹66 (inclusive of taxes) if submitted online through paperless modes

Outside India:

- Physical PAN Card: ₹1,011 (inclusive of taxes) if submitted online through paperless modes

- e-PAN Card: ₹66 (inclusive of taxes) if submitted online through paperless mode

Offline Application:

Within India:

- Physical PAN Card: ₹107 (inclusive of taxes) if submitted at TIN facilitation centres or PAN centres

- e-PAN Card: ₹72 (inclusive of taxes) if submitted at TIN facilitation centres or PAN centres

Outside India:

- Physical PAN Card: ₹1,017 (inclusive of taxes) if submitted at TIN facilitation centres or PAN centres

- e-PAN Card: ₹72 (inclusive of taxes) if submitted at TIN facilitation centres or PAN centres

You can track the status of your PAN card application online through two main portals: NSDL (now Protean) and UTIITSL. Here are the steps for each:

Through NSDL (Protean):

- Visit the NSDL PAN/TAN Application Status page: NSDL Status Track

- Select the type of application: Choose “PAN – New / Change Request”.

- Enter your 15-digit acknowledgement number.

- Enter the captcha code and click “Submit”.

Through UTIITSL:

- Visit the UTIITSL PAN Card Status page: UTIITSL Status Track

- Enter your Application/Coupon Number or PAN Number.

- Enter your Date of Birth.

- Enter the captcha code and click “Submit”.

Alternative Methods:

SMS: Send an SMS with your 15-digit acknowledgement number to 57575. Format: NSDLPAN <15-digit acknowledgement number>

Call: Contact the TIN call center at 020-27218080 and provide your 15-digit acknowledgement number

Hey! Do you know if they make any plugins to help with SEO?

I’m trying to get my website to rank for some targeted keywords but I’m not seeing

very good results. If you know of any please share.

Appreciate it! I saw similar art here: Eco blankets

Yes bro you can use Yoast SEO or Rank math SEO